As a result, you just missed an excellent opportunity.Our asset turnover calculator is a useful tool to help you calculate how efficiently a company is using its assets to generate sales, but it takes more than just the calculator to use it effectively during your analysis of a company. If you blindly believe the asset turnover ratio, you’ll be thinking that it’s an inefficient company that’s not worth investing in. However, things could change drastically once research and development finishes, and new service or product shoot the sales upwards. Since the research and development don’t yet bring any sales, it will bring down the asset turnover ratio. If a company is heavily invested in research and development, it will bloat the assets tab. In most cases, items that are related to research and development are listed in assets. One big weakness of the said metric is it doesn’t take into account the future impact of research and development.

Hence, you should never blindly trust it.

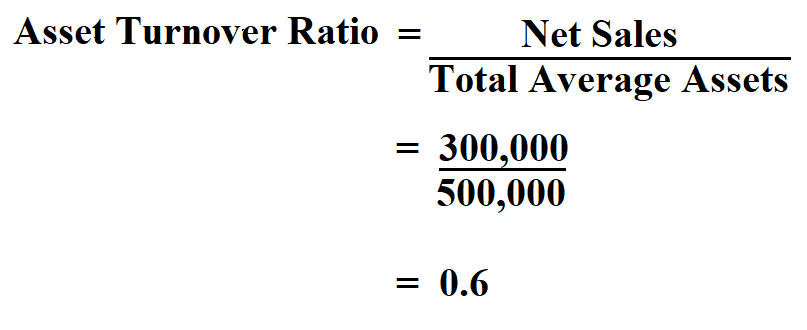

Just like any other metric, the asset turnover ratio has its weaknesses. Such a scenario is a big red flag for investors. In such instances, it could be possible that the entrepreneur or the team may be fond of buying “assets” that do not help in increasing sales. However, upon checking the asset turnover ratio, the company is below average. For example, a company may boast having high sales. In most cases, you will be left with fewer but more efficient companies.įor investors who would want to invest in a company, the asset turnover ratio is a metric that can help reveal hidden and major problems. If you are evaluating several companies for your stock portfolio, you can simply check out the industry standard and use it to weed out the companies that don’t make the cut. In most cases, every sector has an industry standard when it comes to the asset turnover ratio. In reality, even a badly managed online store will still likely have a higher ratio compared to a very efficient manufacturer. If you compare the two together, you may be tricked into thinking that the online store is more efficient than the manufacturer. They also require large storage warehouses. On the other hand, a manufacturer has to buy assets that are needed to produce the goods for selling. An online store requires little assets to produce good sales. For example, it’s not wise to compare the asset turnover ratio of an online store to a manufacturer. However, be careful when comparing two or companies that do not belong to the same sector as the asset turnover ratio may not give you an accurate picture. Generally, the company with a higher ratio means it’s more efficient when it comes to making use of its assets. On the other hand, if a company has a lower asset turnover ratio, it may mean that the company is having production or management problems.Īnother use of the asset turnover ratio is when comparing several companies. Hence, the higher the ratio, the more efficient the company. However, in most cases, it’s not mandatory.Īs mentioned above, the asset turnover ratio is an excellent metric if you want to know how efficient a company is converting sales from its assets. You can also make use of a weighted average if you feel you can get a more accurate picture. This is just a simple way of averaging the assets when you are using two time periods. To obtain the average total assets, you simply add the ending and beginning total assets, and then divide the sum by two.

0 kommentar(er)

0 kommentar(er)